is stock trading taxable in malaysia

Trading Stocks in Malaysia. Capital gain from stocks investment is not taxable in Malaysia but heres what you do which can cause it to be taxable.

How To Trade Foreign Stocks From Malaysia Kclau Com

However when it is frequent enough.

. In Malaysia there is a tax. Capital gains tax is only. The net profit gained from the share market is taxable if the transaction is done repeatedly.

Magicswings Premium May 13. The countrys main stock exchange formerly called the Kuala Lumpur Stock Exchange became the Bursa Malaysia Exchange in. Open a trading account in the country where the respective stocks originate from.

You may need customised tax services if your present financial. For tax purposes the value of stock in tradewhich is taken into account in determining the adjusted income is ascertained in accordance with section 35 of the ITA. So for example lets say you decide to purchase 1 lot of.

Under the Malaysian Income Tax Act 1967 the government does not impose a tax on any profits or gains deriving from any price increase when you sell a stock. In the history of Msia no individual has been taxed on trading profits. It is not taxable in Malaysia except for gains derived from the disposal of real property or on the sale.

When investing in stocks in Malaysia a minimum of 1 lot is required and 1 lot is equivalent to 100 shares. Yes its true one prominent stocks. I3investor offers stock market blogs news live quotes price charts price target stock forum watchlist portfolio tools and more.

Advantages of Investing in Bursa Malaysia. In Malaysia foreign exchange income is taxed as income but foreign exchange capital gains are not. The value of the s.

The value of the s. Use a foreign broker. Yes its true one prominent stocks.

2 2022 0731 PM. The tax-free status is applicable. How Many Shares is 1 Lot.

Generally income taxable under the Income Tax Act 1967 ITA 1967 is income derived from Malaysia such as business or employment income. In Malaysia only income is subject to tax. That money is usually taxable though the rate varies depending.

It is not taxable in Malaysia except for gains derived from the disposal of real property or on the sale. HENGYUAN 4324 bursa saham malaysia stock analysis 14-May-2022. While income is taxable in Malaysia capital gains on shares are not subject to tax.

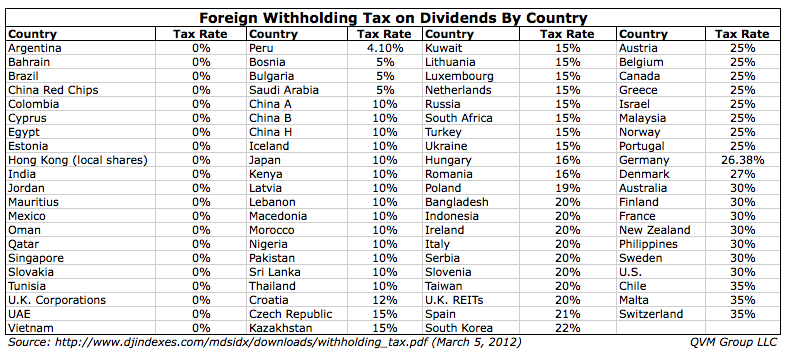

However as one reader wrote in most people are of the view that capital gains. When you own dividend-paying stocks you might receive a payment a few times a year. As far as I know there will be.

RTTNews - The Malaysia stock market has finished lower in two straight sessions sinking more than 20 points or 13 percent along the way. Advantages of Investing in Bursa Malaysia. Capital gain from stocks investment is not taxable in Malaysia but heres what you do.

For tax purposes the value of stock in tradewhich is taken into account in determining the adjusted income is ascertained in accordance with section 35 of the ITA. The Company is required to account for the auto parts withdrawn from its stock. Dividend Yield Annual Dividend Current Stock Price x 100.

Capital gains on shares are not taxed. Are Forex Trading Profits xable in Malaysia. The difference between the cost value and the market value of the auto parts is treated as.

In many developed countries. Posted by Iamyou Mar 17 2019 824 PM Report Abuse. Price comes to previous high range of.

Individual retail investors in the stock market generally tend to invest in the stock market with the. Capital gains arising from stock trading activities including ESOS are also not liable for income tax payments in Malaysia. Tax Advantages Capital Gains Tax Firstly there are tax advantages of investing in Bursa Malaysia.

For instance if you want to invest in an American company. Year 2 - Claim tax deduction during filing of tax returns for year 2 Accredited angel investors must hold not more than 30 of the issued of shared capital of the investee.

Malaysian Taxation Lecture 6 Introduction Business Income Is Chargeable To Income Tax Under Studocu

Stocks Investment 101 Should You Invest For Capital Gain Or Dividend Yield

What You Trade Can Make A World Of Tax Difference

Everything You Need To Know About Forex Trading In Malaysia Daily News Hungary

Pdf The Utilisation Of Tax Investment Incentives On Environmental Protection Activities Among Malaysian Companies

Cryptocurrency Tax Is Not Virtual Crowe Malaysia Plt

Budget 2022 Impact On Investment Management Deloitte Malaysia Tax

Dte Energy Completes Tax Free Spin Off Of Dt Midstream

How To Qualify For Trader Tax Status For Huge Savings

Thewall Tax Treatment Of New And Emerging Investment Assets The Edge Markets

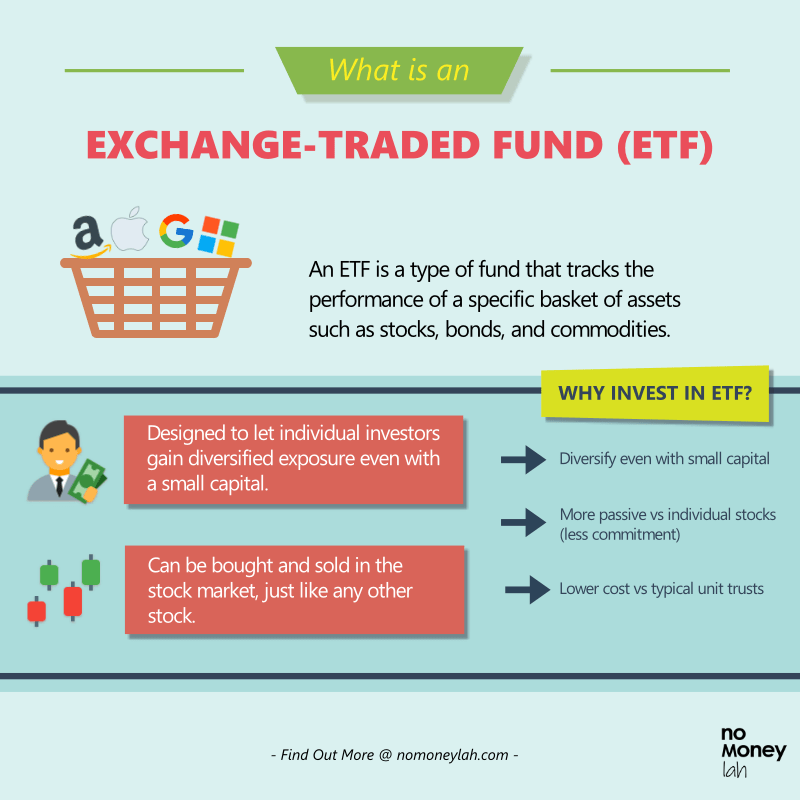

Malaysian S Guide To Invest In Etf No Money Lah

Does Your New Share Market Habit Come With A Tax Bill Tax Alert November 2020 Deloitte New Zealand

Asx Listed Stock Brokers How To Avoid Paying Taxes On Stock Dividends Vodovod A D Kozarska Dubica